7 Payment App Success Stories [2026]

A payment app lets you accept payments from anywhere, using your mobile phone or tablet. It’s best for business owners and professionals to get payments for products or services occasionally or irregularly.

Starting a payment app is an excellent way of making passive income online. It doesn’t require much initially, and the revenue can be significant.

Payment apps are quite popular nowadays, allowing people to pay for goods and services with the tap of a button on their phones. Creating a new payment app can help you capture a share of this growing industry and virtually endless niche for your business.

In this list, you'll find real-world payment app success stories and very profitable examples of starting a payment app that makes money.

1. shurjoPay ($24M/year)

Fida Haq, the MD and CEO of shurjoPay, came up with the idea for the online payment gateway in 2009 while managing an ATM network in Bangladesh. Recognizing the challenges faced by the e-Commerce sector in the absence of a local payment gateway, Haq decided to create shurjoPay to facilitate online payment collection for merchants. Since its launch, shurjoPay has become a key player in the industry, averaging a transactional volume of $1.5 million per month with over 600 merchants onboarded.

How much money it makes: $24M/year

How many people on the team: 150

Bangladeshi MD and CEO Fida Haq established shurjoPay in the e-Commerce sector in 2010, a payment gateway as a merchant service provider so MSMEs could accept online payments in a country that lacked such a solution; now averaging $1.5M in transactions per month with 600 merchants, and expanding services with QR-based payments and payment links.

2. VizyPay ($20.4M/year)

Austin Mac Nab, the CEO and Founder of VizyPay, came up with the idea for his business after realizing that small businesses in rural America were being overlooked by legacy payment processors. He saw the need for transparent and cost-effective payment solutions tailored to the needs of these merchants, and thus created VizyPay. Since its launch, VizyPay has amassed about 12,000 small business merchants in all 50 states, saved merchants over $27 million in unnecessary card processing fees, and achieved a revenue increase of 28% year-over-year.

How much money it makes: $20.4M/year

How much did it cost to start: $197K

How many people on the team: 110

VizyPay is a bootstrapped fintech that provides transparent and cost-saving payment processing solutions to small business merchants across rural America, with over $27 million saved for merchants through their Cash Discount Program, experiencing a revenue growth of 28% year-over-year in Q1.

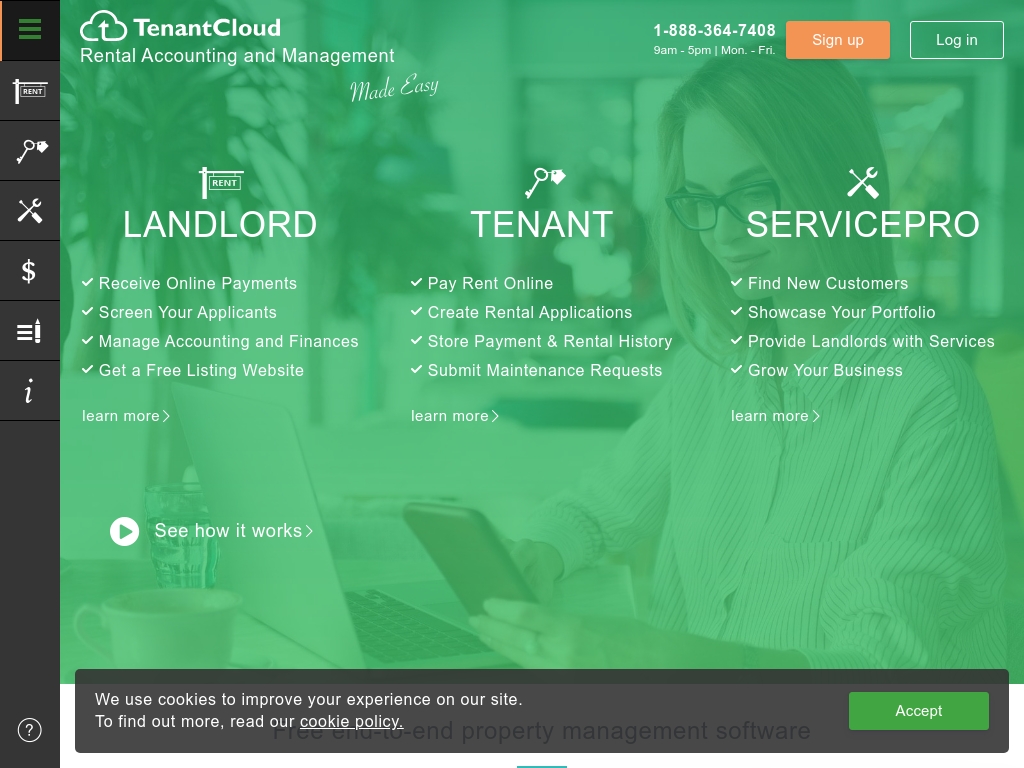

3. TenantCloud ($12M/year)

The founder of TenantCloud, who grew up in a small reservation town, became both an investor and a landlord, experiencing the challenges firsthand. Recognizing the need to streamline property management for landlords, they created a product that combines various functions such as rent collection, tenant screening, maintenance scheduling, and accounting all in one platform, catering to the 15 million landlords in the US who own 21 million rentals and house 60 million tenants. With a projected revenue of $15 million in 2021, TenantCloud has achieved profitability and plans to continue growing by making strategic acquisitions in the future.

How much money it makes: $12M/year

How much did it cost to start: $250K

How many people on the team: 130

TenantCloud is a leading property management software designed to assist DIY landlords in managing their rental properties, with revenue projected to reach almost $15 million by the end of 2021.

4. Factofly ($1.8M/year)

Jannik, the co-founder and CEO of FactoFly, came up with the idea for the business after experiencing the burden of administration as a freelancer. Through extensive market research and interviews with freelancers, he saw a need for a platform that would handle the administrative tasks for freelancers, allowing them to focus on their work. Since its launch, FactoFly has grown its revenue to around €130k monthly and is now preparing for a seed round to expand into new European regions.

How much money it makes: $1.8M/year

How much did it cost to start: $50

How many people on the team: 4

FactoFly, a platform for freelancers to handle their administrative tasks, has grown from 0 to €130k monthly revenue in 12 months, and is preparing for a seed round and expansion to other European regions.

5. Akurateco ($1.2M/year)

The founder, Vladimir Kuiantsev, came up with the idea for Akurateco after realizing that global merchants needed a more advanced and flexible tool to manage their payment processes. With over 15 years of experience in the payment processing industry, he and his team developed a white-label payment orchestration platform that provides maximum flexibility and accommodates the needs of online merchants to grow fast without significant investment. Since its launch in 2020, they have seen exponential growth in transactions and aim to achieve a capitalization of $100+ million in the next 5-7 years.

How much money it makes: $1.2M/year

How much did it cost to start: $600K

How many people on the team: 45

Akurateco, a Netherlands-based payment software provider for fintech companies, bootstrapped their white-label payment SaaS to reach 1 million transactions, receiving recurring payments from 20+ clients every month with an average of €5,000 per client, and they plan to break even by Q2 2022 and achieve a capitalization of $100+ million in the next 5-7 years.

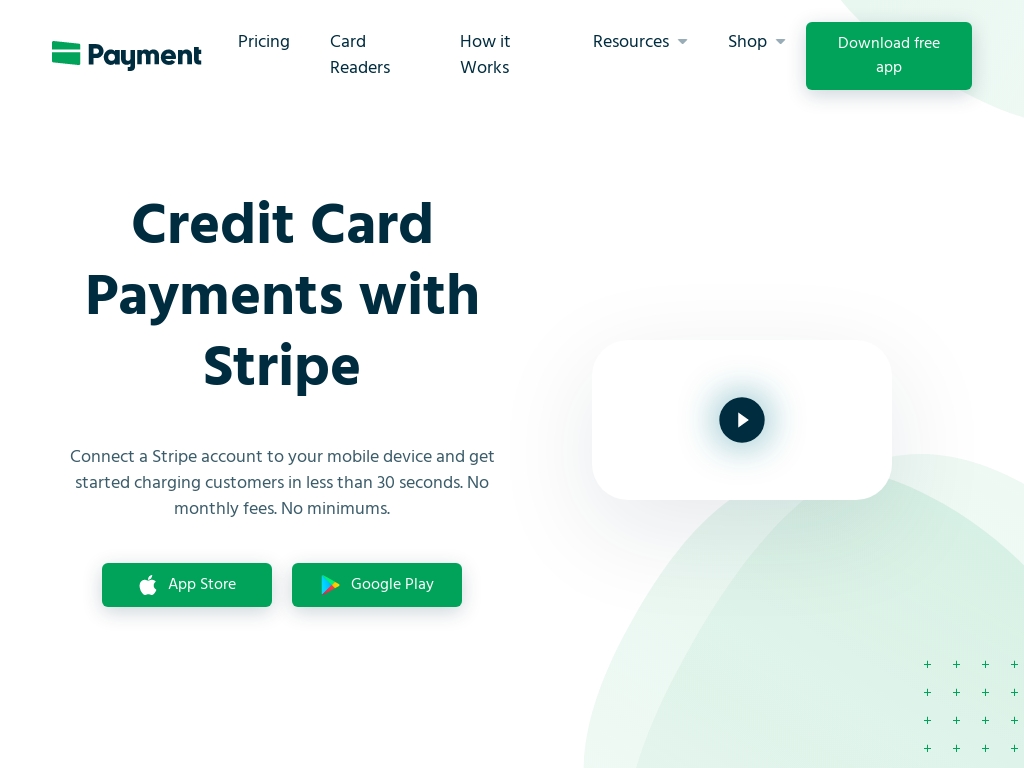

6. Payment for Stripe ($1.5M/year)

Ryan Scherf, founder of payment.co, came up with the idea for his app while working on a previous analytics app for Stripe. He saw a gap in the market for an app that would allow users to collect card-present payments, and decided to fill that void with Payment. Since launching in 2015, the app has processed over $70M in volume annually and collects a 1% service fee on every charge.

How much money it makes: $1.5M/year

How much did it cost to start: $0

How many people on the team: 1

Payment.co, an app built on top of the Stripe payment gateway for creating card-present charges, has grown to process over $70M in volume annually since launching in 2015, with the app collecting a 1% service fee on every single charge.

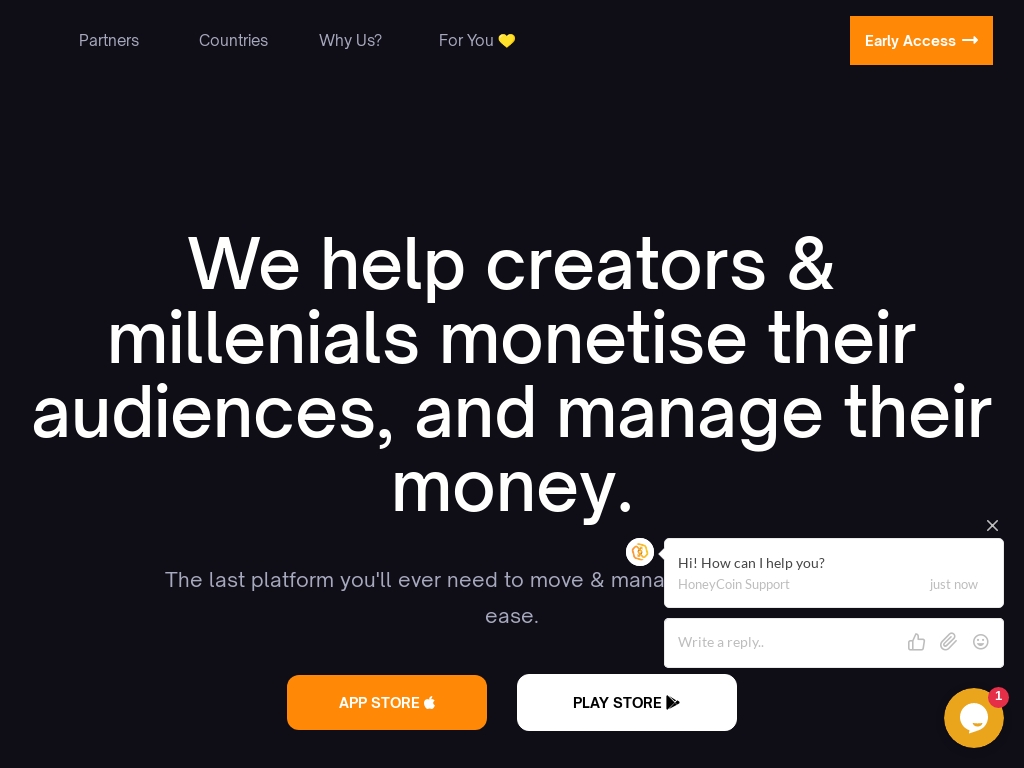

7. HoneyCoin ($12K/year)

David Nandwa founded HoneyCoin after experiencing frustration with payment platforms that were expensive, had restrictions for young people, and had unfriendly user experiences. He also saw the potential for independent creators in Africa to make significant earnings and wanted to create a platform that catered to their needs. HoneyCoin is now profitable and will be raising capital to handle increased demand after its public launch.

How much money it makes: $12K/year

How much did it cost to start: $150

How many people on the team: 0

HoneyCoin is a payments app that helps creators and internet businesses monetize their audiences by managing cash and cryptocurrency all in one place, which processes an average of $10k per month in revenue and has onboarded 504 people.