Top 12 VC Firms In Nigeria [2025]

Are you looking for a VC firm for your Nigeria-based startup?

Nigeria's startup ecosystem is on the move, making the country a leading hub for entrepreneurship on the continent.

According to statista, Nigeria has the highest number of Fintech startups in Africa.

With 0ver 140 fintech startups, Nigeria marks another significant validation of Africa's budding Fintech sector.

There are a number of successful venture capital firms in Nigeria and we've curated a list of the best local firms in the area. Additionally, we provide you with:

- Investment size

- Funding stages

- Typical industries the firm works with

- Well known companies the VC firm has invested in

Here's the list:

1. Microtraction

- Location: Lagos, Nigeria

- Industries: Technology

- Investment Range: $25K - $150K

- Stage: Early Stage

- Companies invested in: Riby, 54gene, Sendbox, Bitsika, Festival Coins, Termii, Thankucash.

Microtraction is a pre-seed VC firm investing around $25K to $150K into Africa’s most remarkable technical founders. The VC firm identifies the best early-stage growth-driven firms aspiring to bring disruptive changes in the technology sectors and works closely with them.

Along with pre-seed funding, they also provide professional advisory services to ensure business success.

Learn more about Microtraction ➜

2. LeadPath Nigeria

- Location: Lagos, Nigeria

- Industries: Technology

- Investment Range: $25K to $100K

- Stage: Seed Stage

- Companies invested in: PayStack, Piggyvest, TeamApt, PushCV, Mono, Gloo,

LeadPath is a seed-stage VC firm providing short, medium, and long-term funding to startups focusing on high-growth technology. Their average investments fall in the range of $25K to $100K.

Since its inception, the firm remains focused on providing technology-focused entrepreneurs with the required mentorship and enabling environment & course funding.

Learn more about LeadPath Nigeria ➜

3. Unique Venture Capital

- Location: Lagos, Nigeria

- Industries: Sector Agnostic

- Investment Range: Up to N500Million

- Stage: Early Stage

- Companies invested in: New Day Concepts, Bankers Warehouse, TL Farms, Trade Conection, Clear Essence Spa, Emperor Chopstick, Beta Computers.

Unique Venture Capital is an SME-Focused private investment firm. This Lagos-based firm invests in the private security of unlisted companies with excellent growth opportunities.

They provide financial advisory services and management consultancy, helping portfolio companies achieve their business goals. Unique Venture provides funds up to N500Million to its portfolio companies.

Learn more about Unique Venture Capital ➜

4. Spark Capital

- Location: San Francisco, Boston, MA, Nigeria

- Industries: Consumer, Enterprise, Hardware, Fintech, Frontier, Tech, Marketplaces

- Investment Range: Not disclosed

- Stage: Series A

- Companies invested in: Oculus, Slack, Discord

Spark Capital seeks to invest in products they love, innovative ideas, people, new markets, future of technology, community, dreams, art, and much more.

This firm provides rock-solid support in the form of capital & guidance and sticks with their companies through every up & down.

They get involved more as a partner & less as an owner and likes to work side by side with their companies in order to make their entrepreneurial dreams into reality.

Learn more about Spark Capital ➜

5. TLcom Capital

- Location: Nairobi, Kenya, Lagos, Nigeria, London

- Industries: Technology

- Investment Range: $500K - $10M

- Stage: Seed Stage

- Companies invested in:Andela, Twiga, Ajua, Shara, Pula, Ilara Health, Autocheck, Media Lario, Persado, Upstream.

TLcom invests in early to growth-stage companies focusing on Technology. The venture capital firm invests between $500k and $10M in fast-growth technology-enabled businesses. From semiconductor manufacturing to mobile solutions and services, TLcom Capital remains committed to ensuring adequate financial support in order to uplift the performance of target companies.

Learn more about TLcom Capital ➜

6. Rise Capital

- Location: Silicon Valley, Mexico City, Sao Paulo, Lagos, Dubai, Mumbai, Singapore.

- Industries: Internet Companies

- Investment Range: Not Disclosed

- Stage: Early Stage

- Companies invested in: Facily, Kueski, GAIA, MiSalud, InstaCarro

Rise Capital is a VC firm targeting leading internet companies within the largest emerging markets. The firm backs industry-leading companies that attack addressable market opportunities leveraging its experience as emerging internet operators within the target markets.

Learn more about Rise Capital ➜

7. Greentec Capital

- Location: Nigeria, Namibia, France, Germany

- Industries: Agriculture, Sustainable Resources, and Digitization

- Investment Range: Not Disclosed

- Stage: Early Stage

- Companies invested in: ShapShap, T40, Lafaaac, Amitruck, Pricepally, Powerstove.

GreenTec Capital invests in startups that focus on Agriculture, Sustainable Resources, and Digitization. The VC firm supports African Startups and SMEs that combine social and environmental impact with financial success.

GreenTec uses the capacity building, process optimization, and a diverse team of international experts to help them implement and adapt the latest technologies to their models so that they can extend their value chain and have more impact locally.

They provide custom-tailored operational support to transform companies and help them create the additional benefit necessary to bridge funding gaps and early crucial phases.

Learn more about Greentec Capital ➜

8. Echo VC

- Location: Nigeria, Kenya, South Africa, Uganda, Brazil, Chile, Mexico, India, Pakistan

- Industries: Technology

- Investment Range: Not Disclosed

- Stage: Early Stage

- Companies invested in: Grto Intelligence, Migo, Kbox Global, ToFa, eBango, FinAccess, PayJoy, PNG.ME

Echo VC invests in early-stage technology-focused companies. The VC firm targets women and underrepresented founders. The Sector agnostic VC firm targets companies within the smart planet, health services, emerging Fintech, media & Entertainment, among other sectors.

The VC firm aims at supporting founders and teams they have backed and offering them with all the necessary support required for their growth.

9. Greentree Investment Company

- Location: Lagos, Nigeria

- Industries: Technology

- Investment Range: Not Disclosed

- Stage: Early Stage

- Companies invested in: CrowdForce, Tizeti, ThriveAgric, Printivo, Accounteer, RelianceWHO, CrowdForce, GeroCare, Proteach, Wesabi.

GreenTree Startup Company invests in early-stage startups, providing the entrepreneurs with what they need to build successful companies. The VC firm aims at rapidly growing the Tech-scalable businesses by leveraging their extensive and collective expertise to grow and add value.

They provide access to funding and help portfolio companies implement a strong corporate governance framework to ensure they are building sustainable businesses. GreenTree provides technical support through its powerful network of domain experts, professionals, and enablers.

Learn more about Greentree Investment Company ➜

10. Ventures Platform

- Location: Lagos, Nigeria

- Industries: Technology

- Investment Range: Not Disclosed

- Stage: Early Stage

- Companies invested in: Pre-seed to Series A

Ventures Platform is a VC firm investing in early-stage mission-driven companies. The VC firm aims at building capital-efficient platforms that work towards democratizing prosperity, building infrastructure, and connecting underrepresented communities.

They typically invest up to $500Million as follow-on capital.

Learn more about Ventures Platform ➜

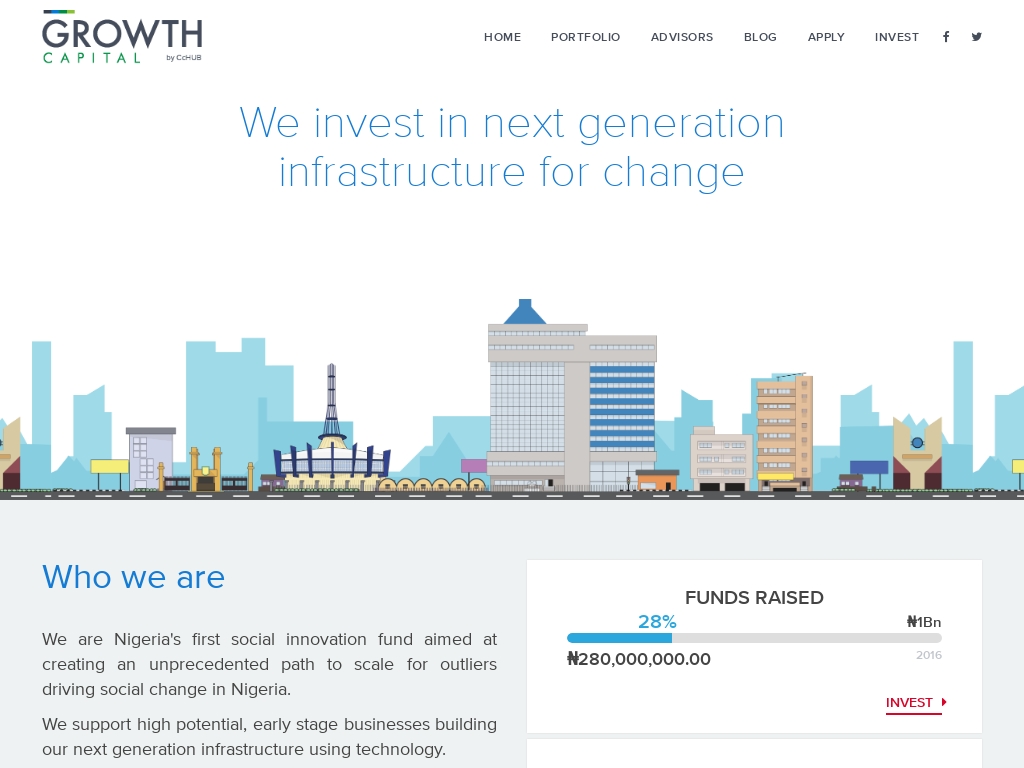

11. Growth Capital Fund

- Location: Lagos, Nigeria

- Industries: Technology

- Investment Range: Not disclosed

- Stage: Early Stage

- Companies invested in: Taeillo, Edves, Riby, Lifebank, DeliveryScience, DrugStoc.

Growth Capital Fund is a social innovation fund seeking to create an unprecedented path to scale for outliers driving social change. The VC firm supports the high potential early-stage companies focusing on building the next generation infrastructure using technology. They are based in Lagos and focused on bringing new change to the tech sector in Nigeria and boosting the economy.

Learn more about Growth Capital Fund ➜

12. GreenHouse Capital

- Location: Lagos, Nigeria

- Industries: Sector Agnostic

- Investment Range: Not Disclosed

- Stage: Early Stage

- Companies invested in: Appzone, BBFree, BoxCommerce, CPCredPal, Gibson DevCenter, Growth Capital, Indicina.

GreenHouse Capital is a platform connecting startups, corporate, and investors that focus on driving innovation in Africa. The VC firm targets disruptive firms that accelerate promising entrepreneurs, and design innovation programs forward. GreenHouse provides more than just venture capital. They offer management support to portfolio companies and guide them through the growth curve.

Learn more about GreenHouse Capital ➜

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.