9 Top Performing VC Firms In Netherlands [2025]

Are you looking for a VC firm for a Netherlands-based startup?

The Netherlands is known for its Agriculture And Food Industry, Energy Industry, and Chemical Industry.

A search conducted in 2019 said that there are over 4,000 startups in the Netherlands, and early 700 of these startups were active in enterprise software.

The Netherlands is the perfect place to start a business as it attracts many international companies as a European base. It is a country known for its open trade culture and its hospitality to foreign entrepreneurs. It lends itself as the perfect base for your European activities

There are a number of successful venture capital firms in the Netherlands and we've curated a list of the best local firms in the area. Additionally, we provide you with:

- Investment size

- Funding stages

- Typical industries the firm works with

- Well known companies the VC firm has invested in

Here's the list:

1. Bio Generation Ventures (BGV)

- Location: Amsterdam, Netherlands

- Industries: BioTech

- Investment Range: $17 Million

- Stage: Seed & Series A

- Companies invested in: New Amsterdam Pharma, TigaTx, Mironid

The BGV group has expansive experience across funding, life sciences, drug advancement, business improvement, and business tasks exercises in biotech and MedTech organizations just as huge pharma. BGV is upheld by logical counsellors with profound industry and scholarly experience.

Their prominent clientele incorporates arGEN-X, Catalym, Dezima Pharma, Citryll, and numerous others.

They invest in the BioTech and the drugs industry, with an average investment of $17 Million.

Learn more about Bio Generation Ventures (BGV) ➜

2. Acrobator Ventures

- Location: Amsterdam, Netherlands

- Industries: SaaS, AI, Marketplaces

- Investment Range: €0.2 - €1.25 Million

- Stage: Pre-seed and seed stage

- Companies invested in: Nomads, Piano, Harver, miro, chocofamily

Acrobator Ventures is a funding firm situated in Amsterdam, Netherlands. As the western beginning phase VC in the CEE-Baltics and CIS area, the firm looks to make interests in pre-seed and seed-stage adjusts in globally centred new businesses.

Acrobator likes to invest in the SaaS, AI, machine learning, marketplaces, ed-tech, ad-tech, marketing tech, and HR tech sectors amongst others.

Learn more about Acrobator Ventures ➜

3. Forbion

- Location: Naarden, Netherlands

- Industries: Lifesciences & BioTech

- Investment Range: $35 Million - $460 Million

- Stage: Seed, Series A & B

- Companies invested in: AM-Pharma, Azafaros, enGene, Numab

Forbion is a major European investment firm that assists organizations with crossing over innovative work through the group's ability in drug improvement and friends building.

Forbion is a signatory to the United Nations Principles for Responsible Investment, and further exhibits the theory that interests in organizations ought to decidedly affect the wellbeing and prosperity of patients.

Their notable clients are Armgo Pharma, AM Pharma, CatalYM, EnGene, and many more.

4. Newion

- Location: Amsterdam, Netherlands

- Industries: Lifesciences & BioTech

- Investment Range: $1.3 Million - $5.6 Million

- Stage: Seed & Series A

- Companies invested in: Passendo, Mediatool, Dexter

Newion is a beginning phase funding firm that puts solely in business programming. They are involved and active methodology, capital, information, and organization, and assist yearning northwest European organizations with developing business sector as market leaders.

Their initial investment is €1-3 million, and a further €5 million per company for follow-on investments

5. HenQ

- Location: Amsterdam, Netherlands

- Industries: Lifesciences & BioTech

- Investment Range: $500k - $5 Million

- Stage: Seed & Series A

- Companies invested in: Stravito, Yoho, Bluetick

HenQ is a Dutch early-stage venture capital firm based in Amsterdam, Netherlands. The firm prefers to make pre-seed to series A investments in the B2B software startups from Europe.

Their investment range is $500k - $5 Million. Their notable clients include Stravito, Yoho, Bluetick, and many more.

6. Exor

- Location: Amsterdam, Netherlands

- Industries: E-commerce, FinTech, IT

- Investment Range: $44 Million

- Stage: Seed, Series A & B

- Companies invested in: SaltPay, Smallhold, Lithic, Karat

Exor is a diversified holding company that makes long-term investments focused on global companies in ECommerce, electronics, financial services, finTech, and information technology sectors.

Their investment range can go up to $44 Million and they typically invest in Seed, Series A & B.

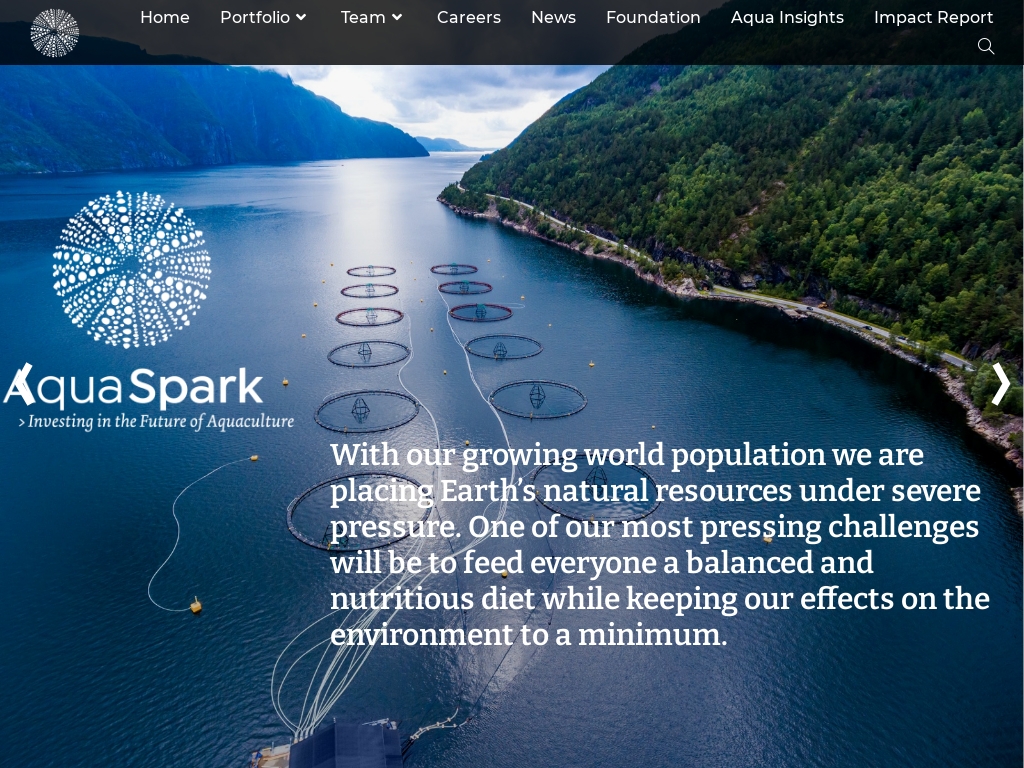

7. Aqua Spark

- Location: Utrecht, Netherlands

- Industries: Agriculture, Lifesciences, Medicine

- Investment Range: $250K - $5 Million

- Stage: Seed & Series A

- Companies invested in: Protix, Ace Aquatec, Molofeed, Hatch

Aqua Spark is a worldwide speculation reserve situated in Utrecht, the Netherlands.

It invests in the hydroponics food framework by putting resources into organizations up and down the hydroponics working to solve industry challenges, with a shared vision of a sustainable future.

Their notable clients include Calysta, Protix, Shiok Meats, and others.

8. Prime Ventures

- Location: Amsterdam, Netherlands

- Industries: SaaS, Marketplaces, Fintech, Consumer, Cyber, Proptech and Deeptech

- Investment Range: $11 Million - $ 30 Million

- Stage: Series A, B & C

- Companies invested in: Mendix, Takeaway, TerraPay, Holidu, and Blueground

Prime Ventures is a pan - European investor with a tech focus. The company was founded in 1999 and invests in the growth stage of companies, typically series A, B, and C. The company made investments in a broad variety of industries – SaaS, Marketplaces, Fintech, Consumer, Cyber, Proptech, and Deeptech.

Currently, Prime Ventures invests from its 5th fund, which is 254 million euros in size. The company invests equity tickets ranging from $11 Million - $ 30 Million.

Learn more about Prime Ventures ➜

9. ZX Ventures

- Location: Mexico, Argentina, Chile, Colombia

- Industries: Sector Agnostic

- Investment Range: Not Disclosed

- Stage: Seed stage - Series A

- Companies invested in: BanQu, BioBrew, Catalant, Foxtrot Systems, Winnin, Pensa, Leaf.

ZX Ventures invests in businesses that focus on meeting the needs of tomorrow. Though this is a sector agnostic firm, still they prefer to invest in the sustainability, Agile industry, and E-commerce industry. They typically fund companies with a promising prospectus and a passionate team with immense faith in their ideas.

Learn more about ZX Ventures ➜