Start A Gold Exchange Traded Funds Business - Business Ideas

Please note that the data provided in this article are estimates and may vary depending on various factors, and should not be considered as perfect or definitive.

Starting a gold exchange-traded funds business requires a great deal of effort, dedication, and most importantly passion.

If you're interested in how to sell gold exchange-traded funds, or selling gold exchange-traded funds online, you can use this page as a guide for everything you'll need to know.

Key Stats

Startup Costs

| Min Startup Costs | Max Startup Costs | |

|---|---|---|

|

Office Space Expenses |

$0 |

$7,000 |

|

Employee & Freelancer Expenses |

$150 |

$250 |

|

Website Costs |

$223 |

$7,015 |

|

Business Formation Fees |

$600 |

$4,700 |

|

Software Expenses |

$162 |

$2,894 |

|

Advertising & Marketing Costs |

$0 |

$1,400 |

|

Total Startup Costs |

$1,135 |

$23,259 |

Successful Businesses

| Business | URL | Rank | |

|---|---|---|---|

|

|

ETF.com |

etf.com |

10,272 |

|

|

ETF Trends |

etftrends.com |

60,126 |

|

|

Global X ETFs |

globalxetfs.com |

63,226 |

|

|

ProShares |

proshares.com |

97,672 |

|

|

VanEck |

vaneck.com |

170,418 |

|

|

First Trust |

ftportfolios.com |

240,925 |

|

|

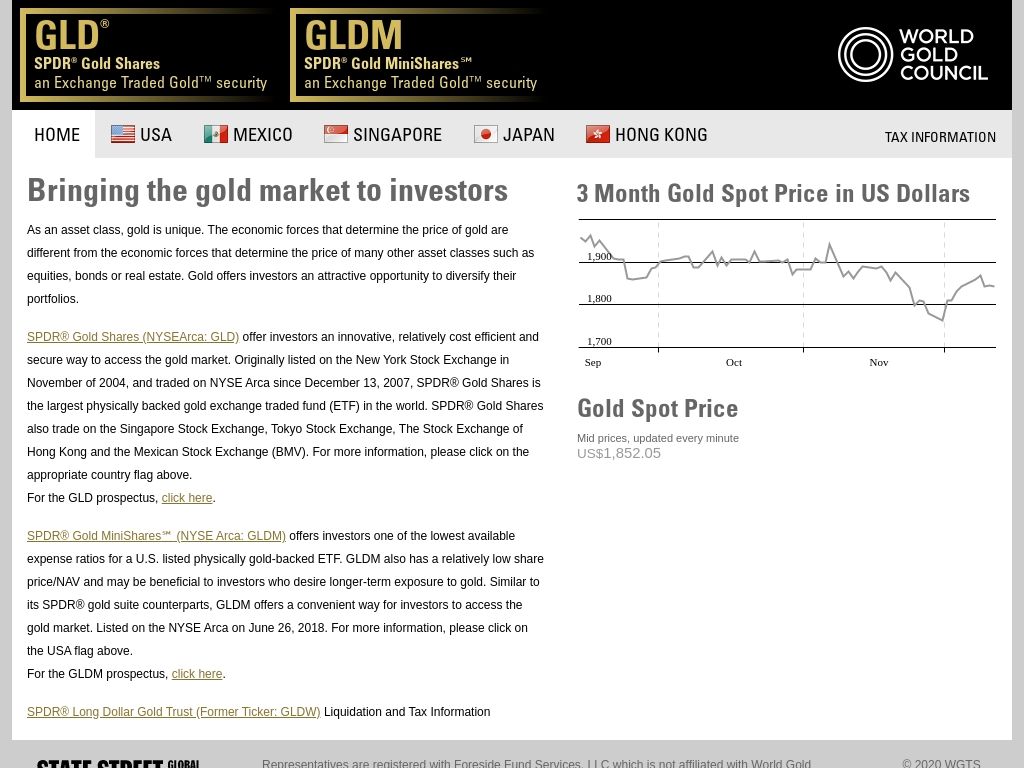

SPDR Gold Shares (GLD) |

spdrgoldshares.com |

289,964 |

|

|

Sprott |

sprott.com |

301,327 |

|

|

Sprott US |

sprottusa.com |

443,490 |

|

|

CI Global Asset Management |

firstasset.com |

1,658,245 |

|

|

Exchangetradedfunds.com |

exchangetradedfunds.com |

3,805,501 |

Pros & Cons

| Pros | Description |

|---|---|

|

Flexibility |

You can put as much time into the business as you'd like. If you like the work and have some initial experience, you can start small and manage all aspects of the business on your own. |

|

Ability to start your business from home |

It's not necessary to have a physical storefront or office space to get your business started. You can do everything from the comfort of your own home, at least in the beginning! |

|

Little startup costs required |

The cost to start a gold exchange-traded funds business costs significantly less money than most businesses, ranging anywhere from 62 to 23,259. |

|

Rewarding work |

Starting a gold exchange-traded funds business can be really rewarding work. After all, you are solving an immediate issue for your customer and you're working on something you truly care about. |

|

Scalable |

With businesses and processes changing daily, there will always be demand for new features, products and services for your business. Additionally, there are several different business models and pricing tiers you can implement that will allow you to reach all types of customers. |

|

No overhead costs |

To get your gold exchange-traded funds business started, there are no costs associated with overhead, storage, packaging, etc. This will save you a lot of time and money! |

| Cons | Description |

|---|---|

|

Crowded Space |

Competition is high when it comes to your gold exchange-traded funds business, so it's important that you spend a good amount of time analyzing the market and understanding where the demand lies. |

|

Longer Sales Process |

A gold exchange-traded funds business can be a big time and money investment for your customer, so it's important you plan and predict a longer conversion funnel and stay in communication with potential customers. |

|

Work can be inconsistent |

As a gold exchange-traded funds business, the amount of work assigned to you and schedule tends to be more inconsistent, which may make your income less stable. It's important to set boundaries and budget accordingly based on the amount of work you plan to have. |

|

Lack of benefits |

With a gold exchange-traded funds business, you are typically self-employed and responsible for finding your own insurance, which can be quite costly and time-consuming. |

|

Isolation |

Often times, as a gold exchange-traded funds business, you typically work alone and do not have much face-to-face interaction with other team members. |

|

Taxes |

As a gold exchange-traded funds business, you typically pay self-employment taxes which can be quite high. It's important to understand what you will be paying in taxes each year so you can determine if the work you're taking on is worth it. |

- 4,818 founder case studies

- Access to our founder directory

- Live events, courses and recordings

- 8,628 business ideas

- $1M in software savings

- 4,818 founder case studies

- Access to our founder directory

- Live events, courses and recordings

- 8,628 business ideas

- $1M in software savings

- 4,818 founder case studies

- Access to our founder directory

- Live events, courses and recordings

- 8,628 business ideas

- $1M in software savings

- 4,818 founder case studies

- Access to our founder directory

- Live events, courses and recordings

- 8,628 business ideas

- $1M in software savings

- 4,818 founder case studies

- Access to our founder directory

- Live events, courses and recordings

- 8,628 business ideas

- $1M in software savings

- 4,818 founder case studies

- Access to our founder directory

- Live events, courses and recordings

- 8,628 business ideas

- $1M in software savings

- 4,818 founder case studies

- Access to our founder directory

- Live events, courses and recordings

- 8,628 business ideas

- $1M in software savings

- 4,818 founder case studies

- Access to our founder directory

- Live events, courses and recordings

- 8,628 business ideas

- $1M in software savings